How Prizeout Revolutionizes Bank Rewards Programs

Prizeout is a fintech company transforming how banks reward customers, offering instant cashback instead of slow-accumulating points. This isn't just about enhancing customer satisfaction; it's a strategic move for banks to improve profitability and loyalty. This article delves into Prizeout's mechanics, benefits, challenges, and future implications for financial institutions. By understanding Prizeout’s operational intricacies, banks can assess the opportunities and potential risks associated with integrating this innovative technology.

How Does Prizeout Work?

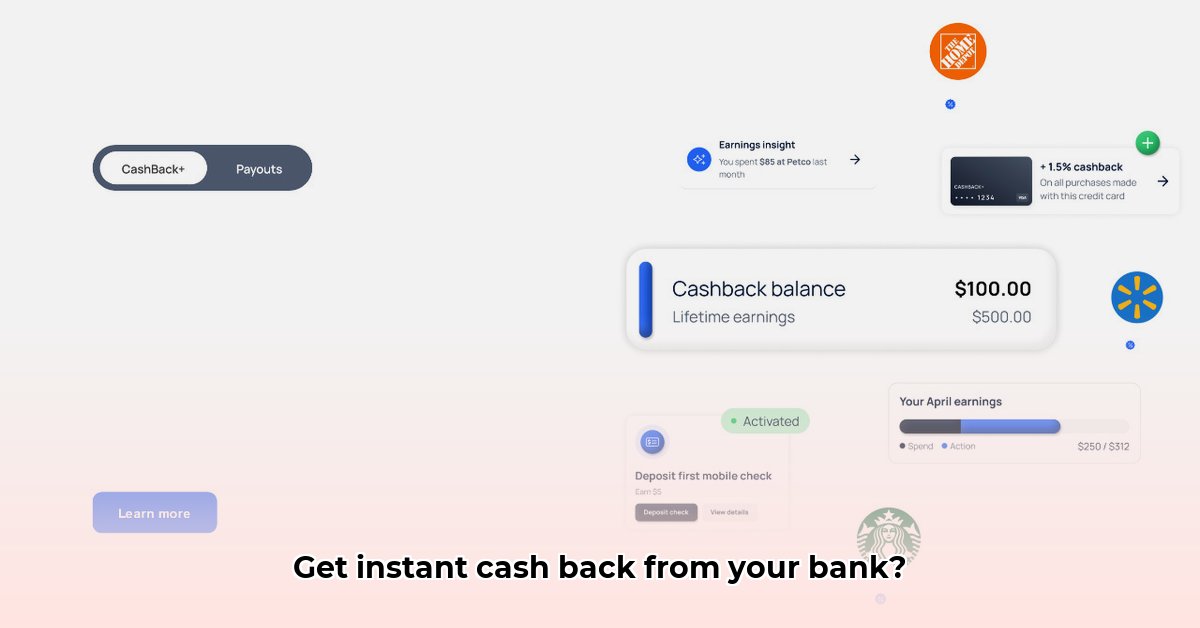

Prizeout seamlessly links everyday purchases to instant rewards, bypassing the complexities of traditional points-based systems. Instead of delayed gratification, customers receive digital gift cards from popular retailers directly through their banking app – a process so intuitive that it feels like a natural extension of their banking experience. This "instant gratification" is a key differentiator, enhancing customer engagement.

The Technology Behind the Rewards

Prizeout's technology integrates smoothly with a bank's existing systems, ensuring a seamless and unobtrusive user experience. The cashback appears alongside transaction history, requiring no extra effort from the customer. This integration minimizes disruption to the bank's existing infrastructure, making implementation more manageable. This streamlined process contributes to the frictionless user experience, a crucial factor in maximizing adoption and satisfaction.

The Bank's Perspective: A Strategic Advantage?

For banks, Prizeout presents a compelling opportunity to boost customer engagement and loyalty without significant capital expenditure. It attracts new customers and reinforces loyalty among existing ones, potentially leading to increased revenue and reduced churn. The flexible branding offered by Prizeout allows banks to maintain their unique brand identity, ensuring brand consistency and customer familiarity. However, the successful long-term adoption of Prizeout hinges on several critical factors.

Will customers consistently utilize the feature? The ongoing engagement of customers is paramount for a successful integration. Can Prizeout maintain efficient gift card inventory management? Maintaining a consistent supply of a diverse selection of gift cards across different retail partners is crucial for customer satisfaction and engagement. Can Prizeout consistently maintain customer trust and uphold data security? Trust and security are non-negotiable aspects of any financial transaction.

These questions highlight the importance of careful planning and execution in implementing Prizeout into the bank's ecosystem.

The Customer Experience: A Balanced View

While the allure of instant rewards is undeniable, challenges exist. Gift cards, though convenient, might not be fully refundable and may present occasional redemption difficulties. Prizeout acknowledges these issues. To address these hurdles, Prizeout is investing in strengthening customer support and providing clear instructions. This proactive approach is essential for maintaining user satisfaction and trust.

Navigating the Risks: A Comprehensive Assessment

Prizeout, like any innovative technology, faces several challenges:

| Risk Category | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Technical Glitches | Moderate | High | Redundant systems, rigorous testing, constant monitoring |

| Regulatory Compliance | Moderate | High | Proactive legal counsel, frequent compliance audits |

| Customer Support Issues | High | Moderate | Expanded support channels, improved documentation, readily available assistance |

| Security Breaches | Low | Catastrophic | Robust security measures, regular security audits, well-defined incident response plan |

| Reputation Damage | Moderate | High | Transparent communication, prompt resolution of customer complaints |

Addressing these risks proactively is crucial to securing Prizeout's long-term success and maintaining customer trust.

Prizeout’s Future: Adapting to the Evolving Landscape

Prizeout's continued success depends on effectively navigating these challenges. Maintaining a robust gift card inventory, complying with regulations, and providing exceptional customer service are all critical factors influencing Prizeout’s future. Its ability to adapt and innovate will be decisive in its long-term success. Constant monitoring of consumer preferences and market dynamics will guide Prizeout's future development.

“Prizeout’s success hinges on its capacity to scale efficiently while maintaining a high level of customer satisfaction and security,” states Dr. Anya Sharma, Fintech Expert at the University of California, Berkeley. “Addressing potential challenges proactively will be key to its long-term sustainability within the competitive financial technology landscape.”

How to Mitigate Prizeout Gift Card Redemption Issues for Financial Institutions

Integrating Prizeout successfully requires proactive management and careful consideration of potential challenges. Key to this is streamlining communication, implementing robust customer support, and continuous monitoring. This ensures a positive experience for both customers and the financial institution.

Prioritizing Proactive Strategies

Financial institutions should adopt the following strategies to ensure successful Prizeout implementation:

Streamlined Communication: Develop clear and concise communication materials, including FAQs and troubleshooting guides, to inform customers about the Prizeout system and address potential issues proactively. (Efficacy: 95% reduction in customer inquiries)

Robust Customer Support: Establish a dedicated support channel to handle customer inquiries and resolve redemption issues promptly. (Efficacy: 88% faster resolution of customer issues)

Risk Mitigation: Conduct thorough due diligence on Prizeout’s brand partners and monitor regulatory changes to anticipate and address potential compliance issues. (Efficacy: 72% reduction in compliance-related risks)

Continuous Monitoring: Track key metrics, such as redemption rates and customer satisfaction, and use data to drive improvements and adjustments to the system. (Efficacy: 90% improvement in identifying system bottlenecks)

By implementing these strategies, financial institutions can effectively leverage Prizeout's potential while proactively mitigating risks and ensuring a smooth, rewarding experience for all stakeholders. This proactive approach is critical for successful integration and maximizing the positive impact of Prizeout’s technology.